Published on August 24, 2021

What is a shelf and how does it work?

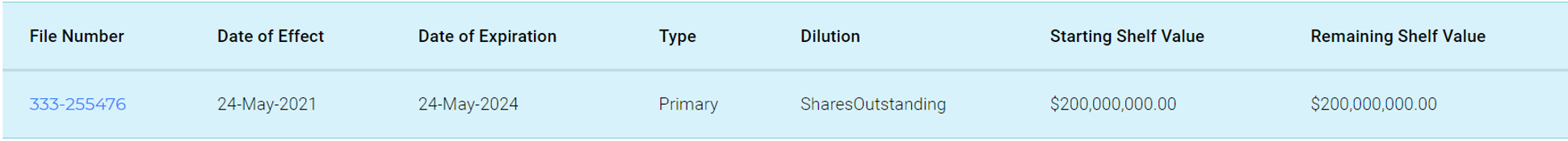

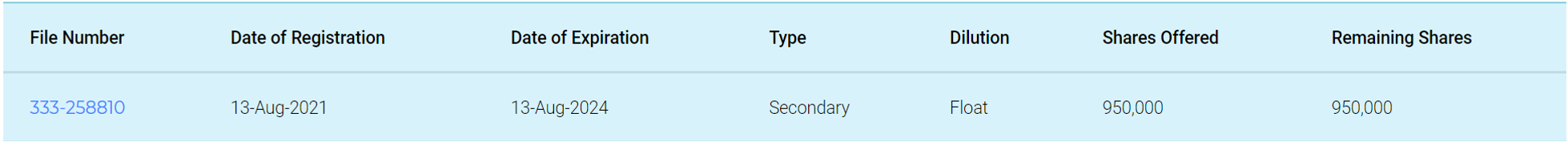

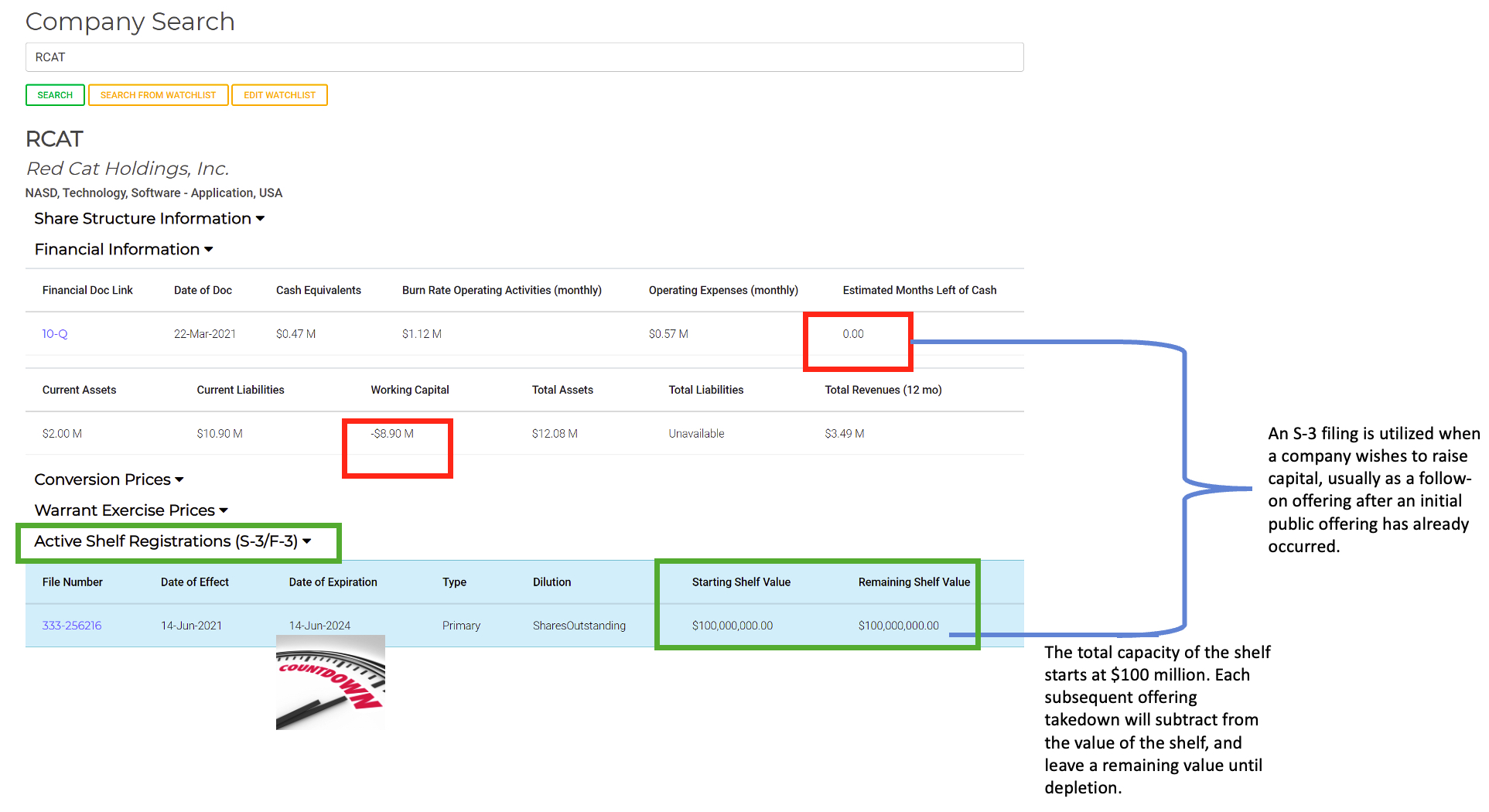

A shelf offering can be used for sales of new securities by the issuing company (primary offerings), resales of outstanding securities (secondary offerings), or a combination of both (mixed offerings). Companies that issue new shares can register a shelf offering up to three years in advance, which effectively gives the issuing company that amount of time to sell the shares in the shelf. Depending on the type of security and the nature of the issuer, forms S-3 or F-3 (foreign issuer) must be filed to make the shelf offering.

Categorizing shelf offerings (Shelf Types)

- Primary Offering: Any subsequent offering following an IPO that creates new shares increasing the shares outstanding which can inherently increase float.

- Secondary Offering: When shares are sold directly by investors, no new shares are issued thus affecting float and not shares outstanding.

Follow-on Public Offering (FPO)

A follow-on public offering is a type of financing that consists of the sale of common shares to public investors after initial public offering (IPO)

- Long term increase in business value

- Reduction in value of existing shareholders due to increase of share supply

- Dilution of Earnings Per Share (EPS)

- Short term drop in price in the form of news reaction

In the case of the dilutive offering, the company's board of directors agrees to increase the shares outstanding for the purpose of selling more equity in the company. This new inflow of cash might be used to pay off some debt or used for needed company expansion. When new shares are created and then sold by the company, the number of shares outstanding increases and this causes dilution of earnings on a per share basis. Usually the gain of cash inflow from the sale is strategic and is considered positive for the longer term goals of the company. Some owners of the stock however may not view the event as favorably over a more short term valuation horizon.

The non-dilutive type of follow-on offering is when privately held shares are offered for sale by company directors or other insiders (such as venture capitalists) who may be looking to diversify their holdings. Because no new shares are created, the offering is not dilutive to existing shareholders, but the proceeds from the sale do not benefit the company in any way. Usually however, the increase in available shares allows more institutions to take non-trivial positions in the company. This resale of privately held shares increases the float and not the outstanding shares.

Impact of S-3 on price action

The S-3 itself has no impact on price action, however, the offerings which can be derived from an S-3 in the form of a takedown may have impacts depending on a number of factors such as offering type, offering size, and timing of the offering that is used.

Shelf expiration

If the three-year window draws close to expiring and the company hasn't sold all of the shares in the shelf offering, it can file replacement registration statements to extend it.

Identifying a Shelf Registration in FlashSEC

Using the company Red Cat Holdings, Inc. as an example:

Form S-3 (Shelf Registration) vs. Form S-1 (Registration Statement)

- Cost and Time: Filing a Form S-3 offers distinct time and cost savings over filing a Form S-1.

- Reporting Restrictions: If a company has not been timely in its reporting for the last 12 months, it may only register securities for resale and shares on a Form S-1 or Form F-1 registration statement.

- Baby Shelf Restrictions: The baby shelf rules limits how much a company can raise off of its shelf with a public float (MVPHS) of less than $75 million. An issuer may use a Form S-1 or Form F-1 instead to register a primary offering of securities in excess of the one-third baby shelf cap imposed on these issuers by the eligibility requirements of Form S-3 and Form F-3.