Published on February 22, 2022

What are stock warrants?

Warrants are a right to purchase shares of the Company's common stock at a specified price (the Exercise Price) for a specified period of time (the Term). Warrants are sweeteners added to offerings and are dilutive when exercised.

A warrant is very similar to a stock option, but the difference is that warrants are issued directly by the company, whereas stock options are securities that are bought and sold between individual investors.

Why would a company issue warrants?

Issuing a stock warrant is one way for a company to raise additional capital or to compensate key employee's. When an investor exercises a warrant, they purchase the stock, and the proceeds are a source of capital for the company.

Type of companies that issue warrants

Most warrants are issued by small companies with 38% being offered by small cap companies, 30.8% by mid cap, and 16% by microcap companies. Warrants are difficult to analyze and risky to invest in for various reasons. Warrants are often issued by shell companies, which are newly formed public companies that are not yet operating as a business. They are formed to enter into a merger or purchase of an operating company.

What are units?

A unit is a security that trades on the stock market like any other security, but it actually consists of two or more securities that have been bundled together as a unit. The combination of securities that can be packaged as a unit varies. Most often, a unit consists of a share of common stock along with a warrant to purchase additional shares of common stock.

Units are primarily issued by special purpose acquisition companies (SPACs). SPACs are also known as blank check companies or shell companies. In fact, SPACs often go public by first issuing a unit, rather than issuing a common stock. SPAC units initially offered through an IPO usually consist of a common stock and a warrant to purchase additional shares of common stock. A few months after going public by issuing a unit, many SPACs will then separately have the common stock and/or warrants start trading under their own stand alone symbols.

Warrant vs. Call Option

Stock Warrant and Call Option are derivatives of a stock. Both are investment securities that an investor can use to generate a profit or leverage in an investment portfolio.

- Meaning: It gives the holder right to avail specific number of shares

- Type of Contract: Non-standardized contracts

- Issuer: Directly from the company

- Dependency: Company issue warrants together with other instruments (eg bonds)

- Terms and Conditions: The issuing company sets the terms and conditions

- Underlying Assets: Currencies and international shares are underlying assets

- Tenure: Life span of Warrants can be up to 15 years

- Tax Rules: Warrants are governed by usual tax rule

- Principles: Warrants follow the principle of cash markets

- Meaning: Buyer gets the right but not the obligation to buy asset at a set price

- Type of Contract: Standardized contracts

- Issuer: Stock exchanges or options exchanges

- Dependency: Stock exchanges issue options independently or as separate product

- Terms and Conditions: Exchanges set the terms and conditions for trading options

- Underlying Assets: Equities, bonds, or indicies are underlying assets

- Tenure: Do not typically stretch beyond one year

- Tax Rules: Call options are governed by different tax rules

- Principles: Option trading follows futures market principles

How long do warrants stay active and when do they expire?

Warrants can have longer time periods than stock options, which often expire in one year or less. Warrants often have a five year exercise periods, and sometimes as long as 15 years.

What are Prefunded Warrants?

Prefunded warrants are a type of warrant that allows the warrant holder to purchase a specified number of a company's securities at a nominal exercise price. The nominal exercise price may typically be as low as $0.01 per share (referred to as "penny warrants"). Unlike standard warrants, prefunded warrants allow the company to receive the exercise price (that would have been due at the time of exercise) as part of the purchase/issuance of the prefunded warrant.

Tradable Warrants

Certain corporations in the US issue publicly traded warrants. These warrants give you the right to buy a company's stock at a specific price during a specific date range referred to as the exercise period. Most warrants give you the right to buy one share of common stock, but that can vary by the warrant. For example, some warrants only give you the right to buy 1/2 of a share of common stock, so you would have to buy two warrants to fully exercise the right to buy one common share.

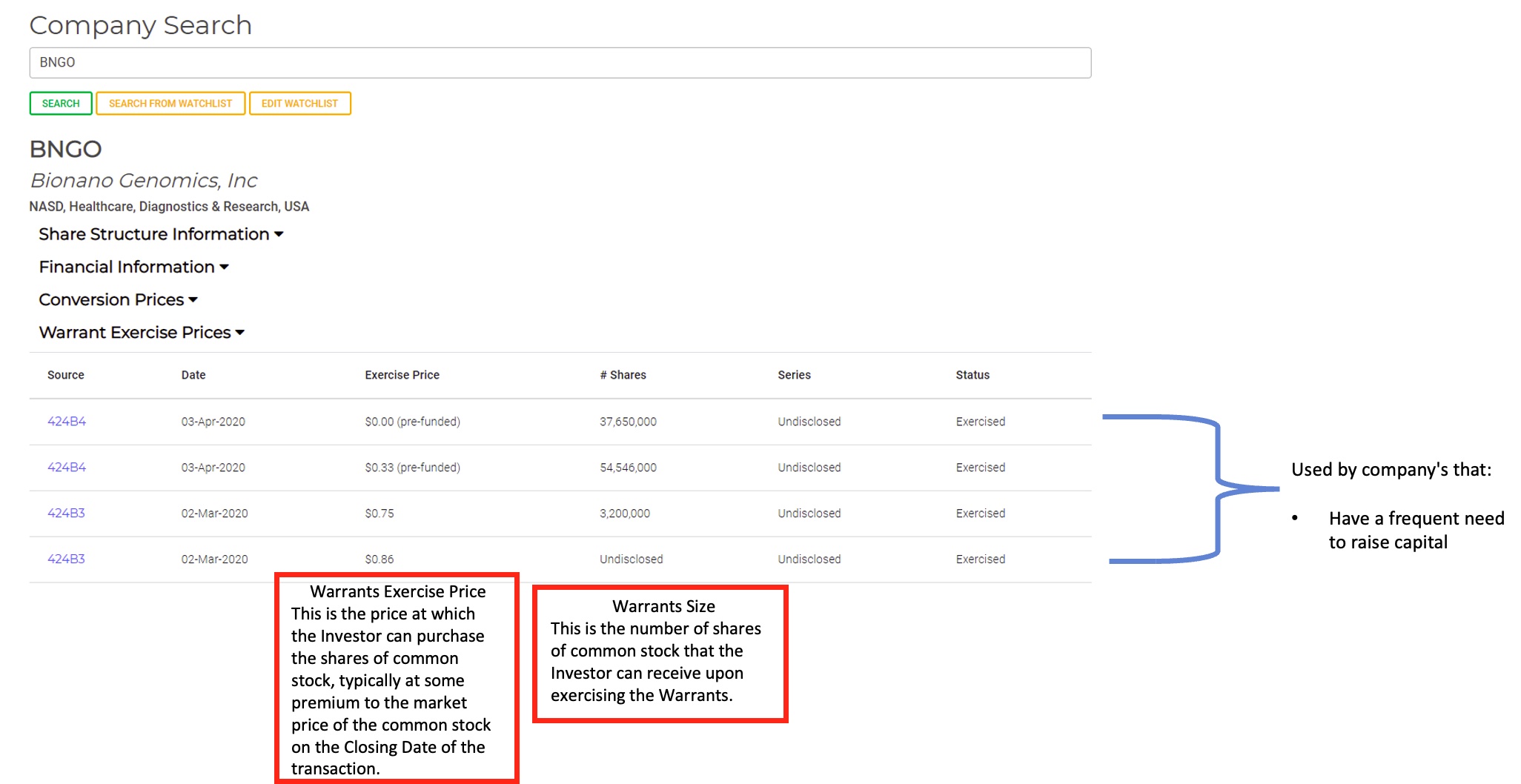

Identifying Warrants in FlashSEC

$CANF Can-Fite Announces Exercise of Warrants for Cash Proceeds of $10 Million . pic.twitter.com/5RpdblMeSX

— FlashSEC (@FlashSec) December 21, 2021

"Dec. 20, 2021 (-- Can-Fite BioPharma Ltd. (NYSE American: CANF) (TASE:CFBI), a biotechnology company advancing a pipeline of proprietary small molecule drugs that address inflammatory, cancer and liver diseases, today announced the agreement by an healthcare-focused institutional investor to exercise certain warrants to purchase up to an aggregate of 150,000,000 ordinary shares represented by 5,000,000 American Depositary Shares (ADSs) having an exercise price of $2.00 per ADS issued by Can-Fite in August 2021, at an exercise price of $2.00 per ADSs.

The ADSs and the ordinary shares issuable upon exercise of the warrants are registered pursuant to a registration statement on Form F-1 (File No. 333-259085) which became effective by the Securities and Exchange Commission (SEC) on August 31, 2021. The gross proceeds to Can-Fite from the exercise of the warrants are expected to be $10.0 million, prior to deducting placement agent fees and offering expenses.

Can-Fite intends to use the net proceeds from the offering for working capital including for the launch of the Phase II study in NASH and Phase III liver cancer study as well as other general corporate purposes."

Impact of Warrants on Price Action

$CANF saw a 42% decrease off of its highs when warrant offering was triggered on Dec. 22, 2021 due to an increase of supply increasing both the outstanding shares and float.

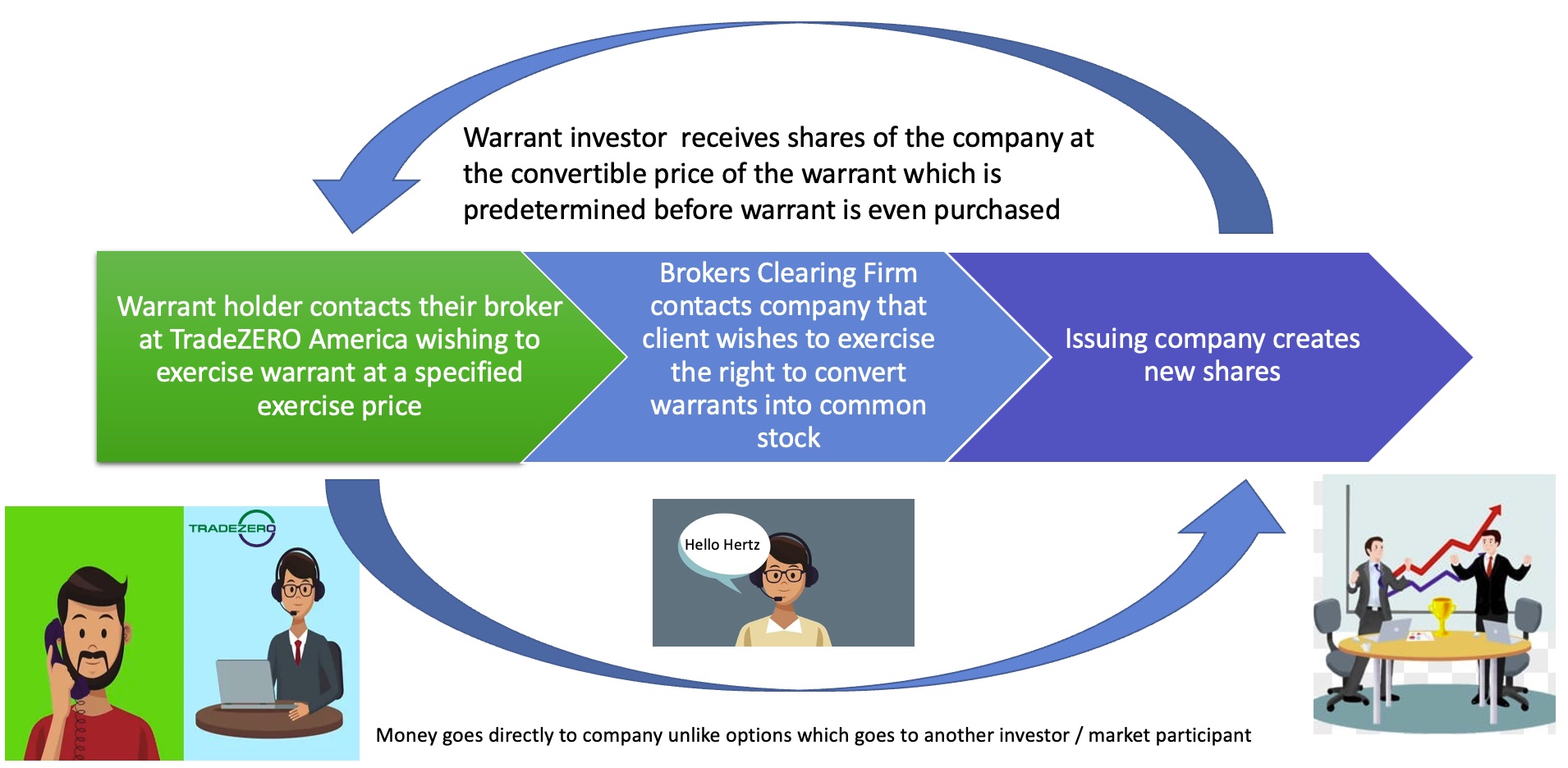

Warrant Exercise Process

There are many ways to trade the markets. Want a broker that offers the flexibility to exercise options and warrants and offers a robust short locate inventory for small cap stocks?

We have parterned with TradeZero to offer you $0 commissions, free TradeZero mobile app, and 3 months of free ZeroPro!

Use Our TradeZero Referral Link Here!